Remote work and digital nomadism are now a part of everyday life for millions of people. However, the ability to work from anywhere also brings responsibilities for the accepting country. It involves the process of identity verification (IDV): from visa applications and apartment rentals to purchasing strong beverages in grocery stores.

Regula, with their partner Sapio Research, surveyed 750 fraud prevention decision-makers and 750 digital nomads across the US, UK, Germany, Spain, the UAE, and Mexico to find out:

- How effectively are businesses adapting to the rise of digital nomadism?

- What technologies do they use to verify nomads’ identities?

- How do nomads experience these ID verification processes in each new destination?

Here’s what we discovered.

Key findings

- 92% of businesses verify more foreign documents than before.

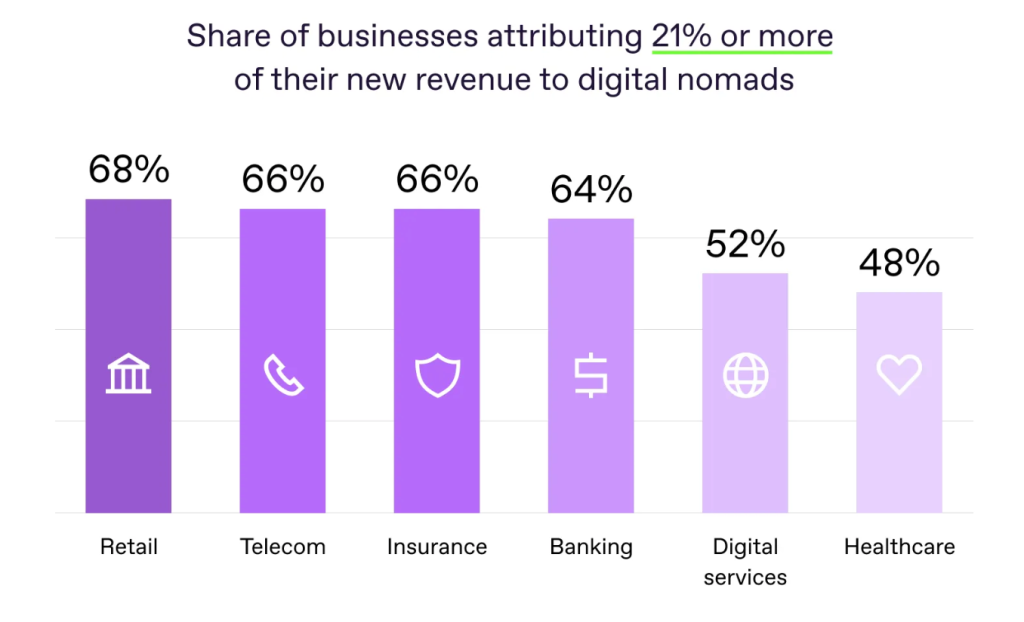

- 50% of surveyed business decision-makers reported a 21% boost in revenue attributed to digital nomads.

- 80% of business decision-makers have noticed an increase in identity fraud, which they directly attribute to the growth of their international clientele.

We explored both sides of the story, businesses and digital nomads alike.

Why study digital nomads in the context of IDV?

What used to be a way of living has now become a global phenomenon. The rise of digital nomadism is transforming business operations, especially in identity verification.

Our research shows that 92% of companies worldwide are now handling a higher volume of foreign documents that require verification. At the same time, half of the surveyed businesses reported revenue growth of 21% or more, attributed to digital nomads. In the United States, 62% of surveyed business decision-makers confirmed this boost.

For businesses, it’s a significant opportunity to grow revenue by effectively adapting to the digital nomad wave.

The digital nomad lifestyle without the glamor

Contrary to the Instagram-style image often associated with the digital nomad lifestyle, the real experience is different. Wherever they go, digital nomads must deal with bureaucratic procedures and often face language challenges. As a result, they deal with identity verification systems more frequently than an average person does.

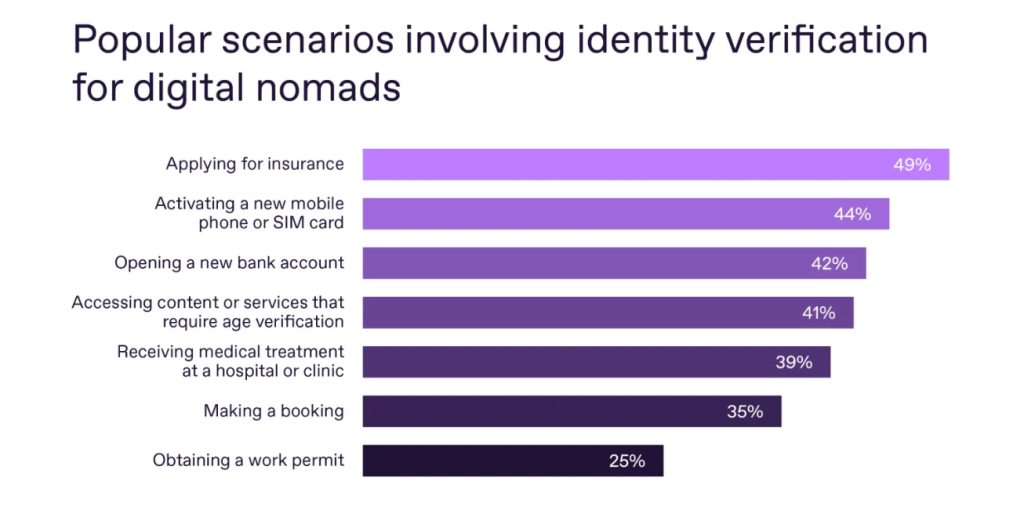

Of course, the exact situations vary by country. For example, digital nomads face the need to verify their identity while applying for work permits in the UAE (39%) and the US (36%) more frequently than nomads in other regions. In Mexico, digital nomads tend to apply for insurance and verify identities more often (60%) than in Germany (28%).

Not all countries are equally well equipped to cater to digital nomads’ needs

While exploring the digital nomad experience, Regula identified a range of common situations in which nomads need to verify their identity.

They also compared how smoothly these activities are performed across six locations popular among the digital nomad community: the United States, the United Kingdom, Germany, Spain, the United Arab Emirates, and Mexico.

This analysis brought to light a comparative ranking of countries where businesses face the greatest challenges in accommodating users with foreign identity documents.

| Country | The most frustrating ID verification scenario |

|---|---|

| Germany | Renting an apartment – 16% |

| Mexico | Applying for new documents – 30% |

| Spain | Conducting financial transactions – 17% |

| UAE | Applying for a visa – 25% |

| UK | Opening a new bank account – 21% |

| US | Buying airline tickets, registering at car-sharing services – 22% |

| Country | The most user-friendly ID verification scenario |

|---|---|

| Germany | Renting a car – 17% |

| Mexico | Checking into a hotel – 26% |

| Spain | Checking into a hotel – 21% |

| UAE | Opening a new bank account – 26% |

| UK | Checking into a hotel – 22% |

| US | Checking into a hotel, Opening a new bank account – 22% |

Surprisingly, the United States turned out to be the most challenging destination for foreign passport holders regarding identity verification. Digital nomads there reported notable difficulties at several stages of their journey — particularly when buying airline tickets (22%), crossing the border (21%), and checking into hotels or renting accommodation (19%).

In the second spot, the United Arab Emirates presents its share of hurdles, particularly related to applying for a visa (25%), followed by applying for new documents (18%). 17% of surveyed nomads had difficulties with essential tasks such as purchasing airline tickets, checking into hotels, and completing medical insurance forms.

In contrast, Germany emerged as a standout example of efficient identity verification for foreign nationals. While long-term accommodation remains a pain point, most other procedures — such as opening a bank account (10%), filling out medical insurance paperwork (9%), and activating a new SIM card (7%) — are reported to be relatively smooth and hassle-free.

Some painful issues for digital nomads aren’t directly related to identity verification

Once a nomad arrives in a new country, they have a ton of formalities to handle within a tight deadline: finding a place to live, opening a bank account to pay bills, getting a local SIM card, and more.

The most common issues, however, seem to revolve around validity rather than first-time onboarding anywhere:

- Document validity periods (19%).

Most identification documents come with expiration dates. When a digital nomad is away from their home country, renewing these documents on time can be complicated.

- Proof of residency (19%).

Digital nomads often lack a fixed residential address, making it hard to furnish traditional proof of residency documents like utility bills or rental agreements.

- Information inconsistencies (18%).

Constant travel and changes in location can lead to inconsistencies in the information during ID verification, causing delays or rejections.

- Trust and credibility (18%).

Nomads may encounter skepticism or a lack of trust from institutions due to the unconventional nature of their lifestyle and work arrangements.

The extent of these challenges differs depending on the country. For instance, 25% of nomads in the UAE struggle with proof of residency, compared to just 12% in the UK. Similarly, while only 14% of nomads based in Spain report any issues with the inconsistencies of changing locations frequently, 28% of UAE-based nomads again cite this as a major challenge. And while only 9% of Germany-based nomads report facing a lack of trust from institutions due to their unconventional lifestyle, it remains a challenge for 26% of US-based nomads.

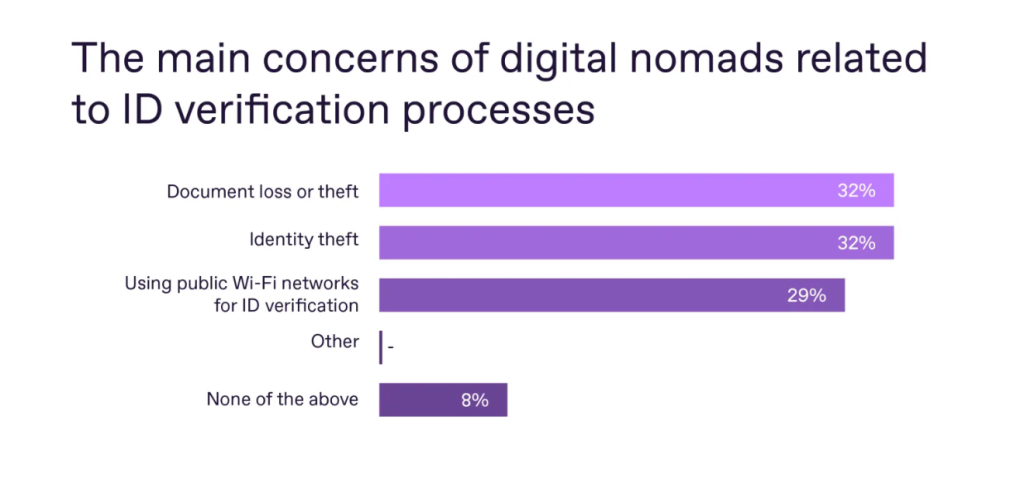

When asked about their main concerns, nomads also highlighted three major risks tied to identity verification:

- Losing or having their IDs stolen — a practical concern when traveling frequently.

- Exposure of personal data — the fear that sensitive identity data might be compromised.

- Cybersecurity threats — reliance on public Wi-Fi for remote verification increases the risk of hacking and other digital attacks.

Businesses have to verify foreign IDs more often

From the business perspective, one of the biggest challenges is the rising volume of foreign document verifications. 92% of businesses have already witnessed an increase, which amounts to 21% on average. Industry-wise, Travel & Hospitality reported the smallest increase (15%), while Insurance (27%) and Finance (25%) are leading the way.

Generally, US passports are the most common in identity verification scenarios abroad: they were submitted in 34% of all verification cases mentioned. This correlates with the general trend that Americans make up the largest share of the global digital nomad community, making streamlined processing of US IDs a smart investment for businesses worldwide.

However, the situation in the United Arab Emirates looks quite different. Unlike in most countries, where three or four nationalities dominate, businesses in the UAE face a far more diverse spread of foreign passports, with a much higher frequency of less common nationalities appearing in verification processes.

The more digital nomads, the more cases of identity fraud

A growing number of businesses are noticing the downside of the digital nomad boom. 80% of surveyed decision-makers reported an increase in identity fraud, which they directly associate with the rising number of nomadic clients. On average, this uptick was estimated at 14%, with the Insurance (22%) and Finance (19%) sectors reporting the highest rates.

This surge has naturally raised concerns about the risks associated with digital nomads. Forty percent of respondents worry that if some nomads attempt to use forged or altered identity documents, detecting these cases could prove difficult. One of the major reasons for this is the lack of document uniformity. Document types and their security features vary between countries, which may cause hiccups in document verification processes.

Another important factor mentioned by 36% of business decision-makers is language barriers. If a document is issued in a foreign language, it makes it difficult for staff to understand the content and accurately verify the information.

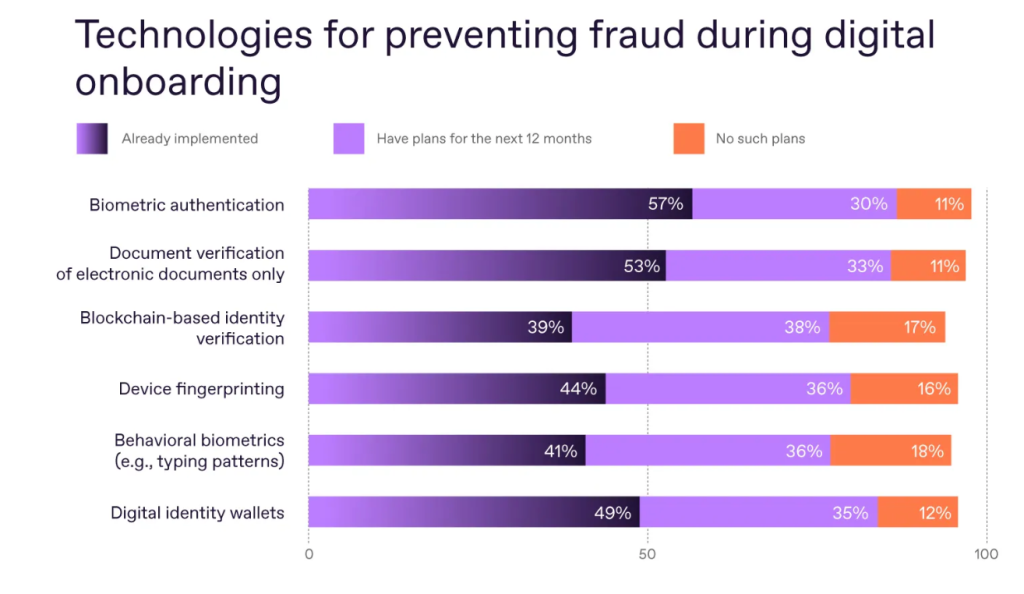

Over half of businesses have already implemented biometric verification and electronic document checks

In response to the shifting landscape, businesses are increasingly adopting innovative technologies for identity verification. They believe they need to increase their IDV budget by 20% to keep up with the trend.

Among the technologies gaining traction, biometric verification leads the way — 57% of respondents have already integrated it into their workflows. Verifying e-documents is the second most popular option: 53% already have it. One-third of those surveyed have plans to implement either option within a year.

Turning frustrations into a nomad-friendly scenario

At the core of these challenges for digital nomads lies an imperfect ID verification flow, with each country and business enforcing its own unique rules, often lacking streamlined processes for foreign document verification.

Organizations can benefit significantly from the rising nomadism trend if they play their cards right. After all, digital nomads are also great consumers at the height of their purchasing power.

Here are three practical recommendations for how organizations can elevate their identity verification workflows by improving both security and the user experience along the way.

Tip #1: Extend the list of supported documents

Regula’s survey revealed that 35% of digital nomads complained about limited ID document type support in some apps. To create a more inclusive verification process, service providers need to expand the range of accepted documents and ensure their systems can handle a wider variety of ID formats.

By broadening the range of acceptable identification documents, businesses can accommodate a more diverse group of users, including those who possess less common types of ID.

However, this is far from a simple task. Collecting a big database of all possible ID variations is a challenge on its own. But being able to regularly and promptly update it brings the task to a whole new level. The issue is that you need a reference template, not only to get a general idea of what a certain document looks like, but to be able to analyze if everything is valid and in the right place.

Fortunately, advanced solutions already exist. Regula’s identity verification technology is backed by a database of over 15,000 document templates from around the world as the most extensive and meticulously maintained collection globally. Thanks to Regula’s deep expertise in document forensics, this resource enables businesses to detect inconsistencies with precision and confidence.

Tip #2: Enable remote identity verification

19% of surveyed digital nomads expressed concern about the lack of remote identity verification options. In today’s digital age, where mobility is a fundamental part of work and life, the ability to undergo identity verification remotely is crucial.

To address this concern, organizations should implement remote identity verification solutions where possible. This not only improves convenience but also aligns with the nomadic lifestyle, allowing individuals to verify their identity while on the move.

Of course, this strategy demands significant technical investment. A robust, world-class remote IDV pipeline typically follows a five-step “ID plus selfie” framework that includes:

- Collecting accurate identity data

- Verifying document authenticity

- Using biometrics to match the document with its holder

- Assessing the quality of submitted images and videos

- Conducting liveness checks, both for the person and the presented ID

The last but certainly not the least critical element is to ensure the secure handling of all sensitive data throughout the process.

Fortunately, there are proven solutions that can cover the whole workflow. Regula is one of the few providers that serves as a one-stop shop for solving this challenge.

Tip #3: Translate services into more languages

Service providers should localize their identity verification services into a broader range of languages to make the identity verification process more accessible and user-friendly.

Businesses can serve a broader audience by helping digital nomads from different linguistic backgrounds complete the verification process accurately and successfully due to multilingual support.

Compared to other improvement strategies, this one is perhaps the one that demands the least resources, as long as you partner with a decent IDV service provider. Despite some natural associated costs, the ability (and willingness) of the IDV provider to offer localization is the most crucial factor to consider. Normally, such investments pay off in no time.