TRAI Mandates ‘1600’ Number Series to Combat Financial Call Frauds

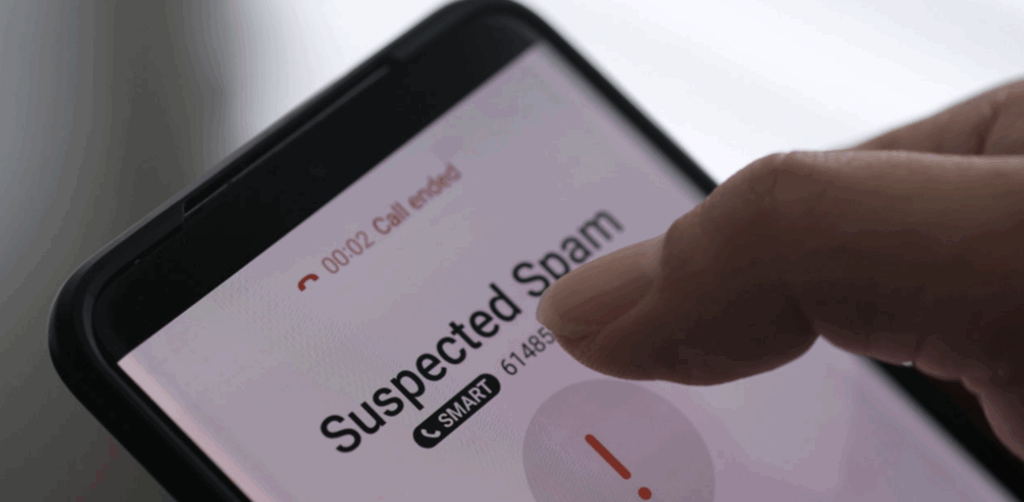

The Telecom Regulatory Authority of India (TRAI) on Wednesday issued a directive mandating phased adoption of the dedicated ‘1600’ numbering series for regulated entities such as banks, NBFCs, mutual funds, and other financial institutions. The move aims to curb impersonation-based financial frauds perpetrated through voice calls and enhance consumer trust in transactional communications.

This ‘1600’ series shall be assigned by the Department of Telecommunications (DoT) and is designated only for the banking, financial services, insurance (BFSI) sector, and certain government organisations. This would empower the citizens to reliably identify legitimate service and transactional calls from regulated institutions, distinguishing them from other commercial or spam communications.

Strict and clear deadlines for adoption of the ‘1600’ series have been set by the regulatory authority:

- Commercial Banks (public, private, foreign): Must adopt by January 1, 2026.

- Mutual Funds & Asset Management Companies (AMCs): Must adopt by February 15, 2026.

- Qualified Stockbrokers (QSBs): Must adopt by March 15, 2026.

- Other SEBI-registered intermediaries: May voluntarily transition after verifying registration details.

- RBI-regulated entities: Large NBFCs, payments banks, and small finance banks must adopt by February 1, 2026, while remaining NBFCs, co-operative banks, regional rural banks, and smaller entities must on-board by March 1, 2026.

- Central Recordkeeping Agencies and Pension Fund Managers: Must adopt by February 15, 2026.

TRAI is still consulting with the Insurance Regulatory and Development Authority of India (IRDAI) on deadlines for insurance sector entities.

TRAI Moves to Mandate ‘1600’ Series, Strengthening Security in Financial Communications

TRAI highlighted that it has engaged with telecom operators and BFSI regulators throughout the process. So far, approximately 485 entities have already adopted the 1600 series, subscribing to over 2,800 numbers. The regulator said the time has now come to mandate time-bound adoption to prevent ongoing use of standard 10-digit numbers, which could facilitate fraudulent calls impersonating trusted financial institutions.

The adoption timelines were developed in consultation with BFSI sector regulators via the Joint Committee of Regulators (JCoR). The phased implementation aims to ensure a seamless transition for all entities while enhancing security and transparency in financial communications

So, now in the sea of ringing echoes, ‘1600’ shall rise as the lighthouse guiding trust to safe harbours. Until then…

Summary

The Telecom Regulatory Authority of India (TRAI) has mandated the phased adoption of the dedicated ‘1600’ number series for banks, NBFCs, mutual funds, and other financial institutions to curb voice call frauds and enhance trust. Assigned by DoT, the series allows citizens to identify legitimate calls. With clear deadlines through 2026, over 485 entities have adopted it, marking a secure, transparent shift in financial communications.